Original Source: Wealthmanagement.com

By: Sune Sorensen

Clients are probably asking about crypto investing, clamoring for help in making sense of it all. As a trusted advisor, you will have wrestled with the desire to help your clients participate in this dynamic space while adhering to a prudent risk management-first principle. I know I have.

Aligning your money with the forces of human ingenuity has long been a winning investment strategy, as innovation applied in core economic sectors is arguably the most consistent and powerful returns generator in history. The digital asset space offers one of the greatest investment opportunities for the decade ahead, but its infancy and constantly evolving nature make it a tricky asset to navigate. Areas involving great leaps in innovation tend to come with plenty of hype and hubris, as well as a few false dawns and burst bubbles before the new paradigm truly sets in. Advisors will have to navigate these ups and downs with a rational approach and strong risk management skills to successfully harness such powerful trends.

Seizing opportunity in a new sector can be an elusive endeavor. Starting with a firm foundation is critical. The following are a few key areas of focus that can inform your best advice for clients looking to participate in the cryptocurrency space:

While Bitcoin sprinted out the gate first and has some interesting attributes, an obvious investment case and a dedicated global network are quickly emerging away from this noisy partisan area. Ethereum (ETH) is the most widely used development platform for blockchain technology, controlling more than 90% of the market share in both application development and transaction volume. With a flexible yet robust underlying blockchain and smart contracts platform, ETH has become the go-to layer one blockchain for decentralized finance (DeFi) applications. Alternative “infrastructure” plays to ETH—Cardano (ADA) and Polkadot (DOT), for example—also offer interesting platforms and eventually we will see cross-platform connectors, which is a key area to observe as it would enable the broader ecosystem to really scale.

DeFi is seeing exponential growth and will likely become a major part of the Fintech 2.0 wave that moves our financial systems and markets to truly digital formats. Consumers and businesses in emerging markets—billions of people—have already leapfrogged the “bank on every corner” model with Fintech 1.0’s move to online smartphone apps. They, and the younger generations in developed markets—who will soon be the beneficiaries of the largest generational wealth transfer in human history—live largely digital lives and adapt to these new solutions seamlessly. Change is not an event, it’s a process. The process is underway for major change.

Liquidity and Volatility

Crypto’s infancy remains a key driver for the asset’s price fluctuation. As we’ve seen in recent weeks, a simple tweet can send its price into double-digit percentage daily swings. Such volatility, as well as the relative illiquidity, must be considered for any investment approach to this fast-evolving space.

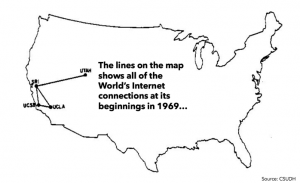

As the illustration below of the early internet days shows, the network effect for an idea that’s time has come is a powerful force. However, always remember to manage the risks and seek to build value rather than chasing prices.

Regulation

Crypto’s maturation in many ways will be based on its regulatory framework. In Switzerland, the country took both a progressive and pragmatic approach that has enabled innovation and provided clear guidelines for entrepreneurs in the space while also ensuring that investors are afforded the same protections they would have in traditional finance. The approach has been based on what Swiss National Bank Chairman Thomas Jordan has described as “economic function.” While the financial industry and financial markets have continuously evolved and new technologies have been applied for centuries, the basic “economic functions” have largely remained the same. In short, if it quacks like a duck, it must be a duck. If it takes the legal appearance of a security or that of deposits for account, it should be treated as such and operators of such instruments should be regulated accordingly.

The U.S. has lacked such a pragmatic approach, which has left investors and entrepreneurs with a confusing morass of noise and flux. Gary Gensler, the recently appointed SEC chairman, is poised to make this area a priority during his term and he brings both progressive values and a healthy dose of pragmatism that should serve the crypto sphere well over time. Gensler is focused on composing long-term policies that protect retail investors. While a lot of the focus currently is on the potential of central bank digital currencies (CBDCs), in my view these are likely to simply replace electronic fiat money with some interesting potential systems-related implications. But the real innovation and potential for investors remains to be found in the private sector and a clear-eyed regulatory framework will serve to unleash these powerful forces while reining in bad actors in the space. This is the foundation required for the innovation to reach its full potential.