The Strategic Funds has converted to a private investment firm and is not taking outside capital at this moment.

Our Strategies

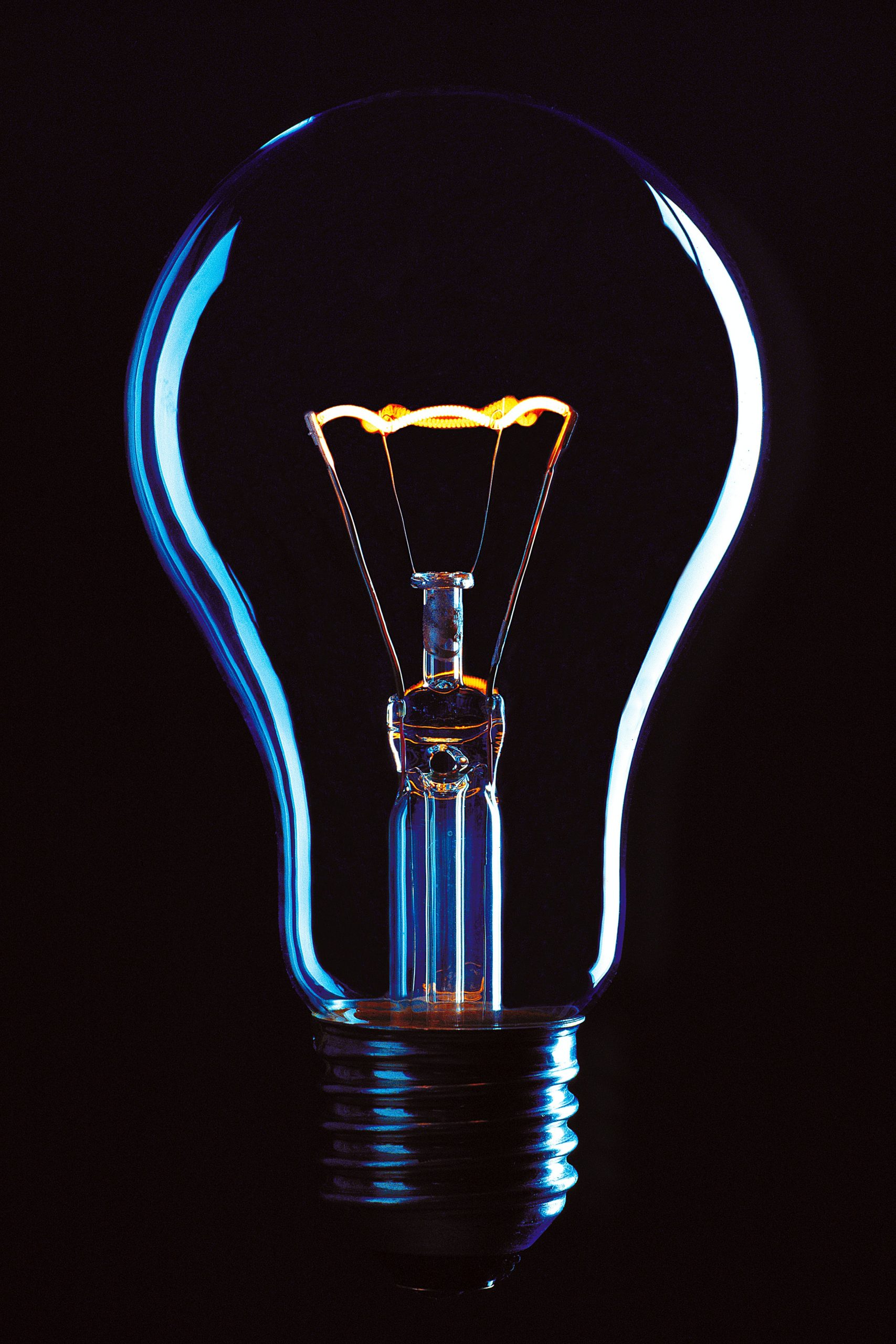

An Algorithmic Approach

We harness global cross-asset opportunities by applying algorithmic systems to major macro trends around the overlooked Edges of global markets.

Get an Edge

Get Strategic.

Energy Trading

We look for opportunities to trade supply/demand imbalances in inefficient segments of the Energy Markets.