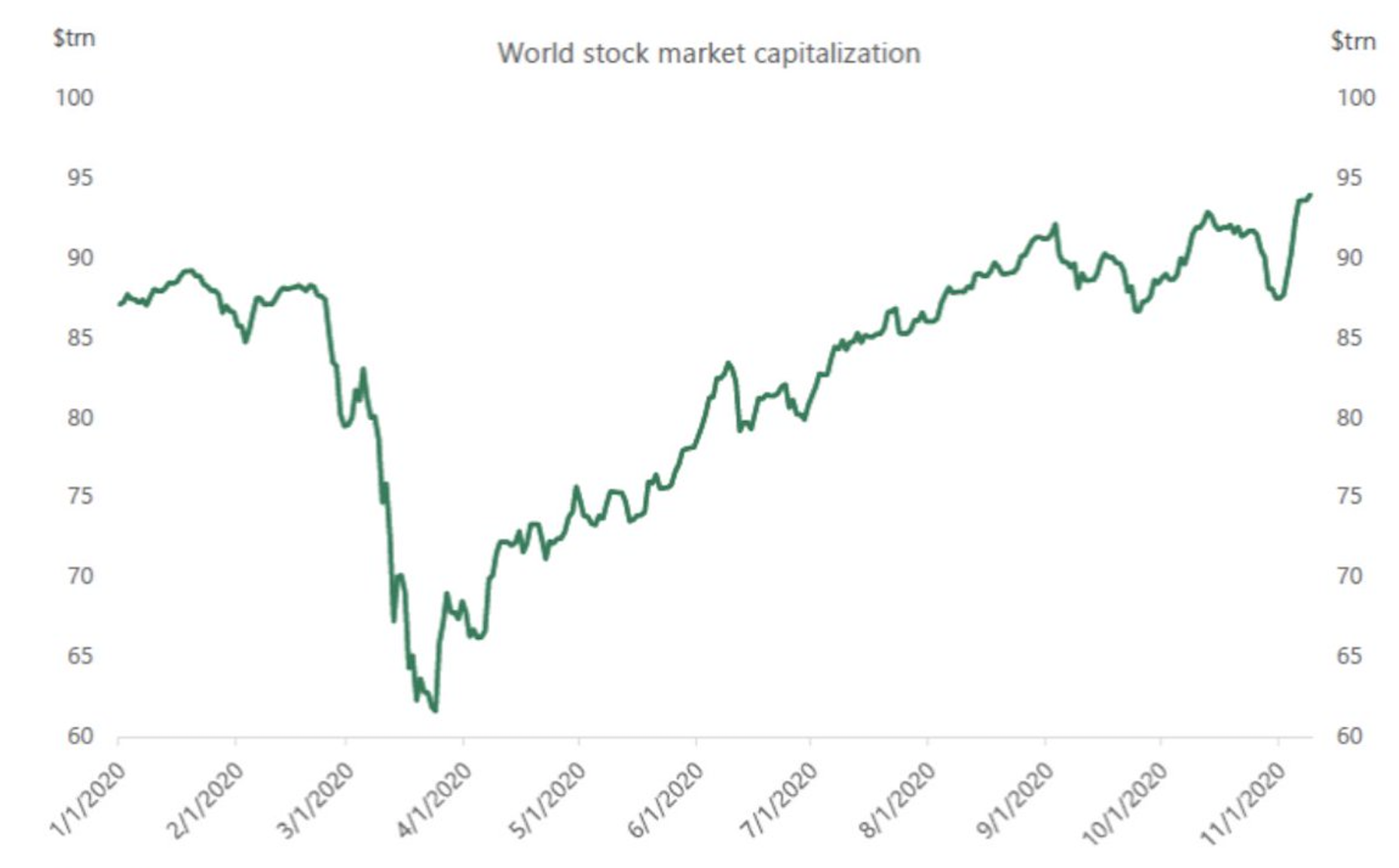

We have climbed the mountain. From the despair of March, as we careened off the cliff of our “permanently high plateau” and panic replaced complacency, we have now recovered all losses and even made some gains on the January highs. Like a Redbull infused bungee jumper on an extra bouncy elastic with ankle weights on, we have bounced back and reached new highs at record speed.

The global stock market cap has hit a new high of $95trln. Yet from this elevated vantage point visibility is still poor, and we find ourselves heading into what used to be marked as ‘Terra incognita’ on old maps. While the terrain may seem eerily familiar to those who have studied history, the scale and complexity takes us off the beaten track. What comes next?

World stock market cap reaches record-high of $95trln.

Sources: Bloomberg, Apollo.

Sources: Bloomberg, Apollo.

In his book, Confusion de Confusiones, from 1688 Joseph de la Vega succinctly sums up the allure, challenges and risks of investing in the stock market. His book is focused around the boom of the stock of the Dutch East India Company on the Amsterdam Stock Exchange, but the lessons are universal and timeless as the affairs of man – especially those involving investing and money – tend to be circular in nature. The following dialogue sets the scene well, and besides the eloquence and the honesty could be most interview’s on CNBC today;

“Philosopher: And what kind of business is this about which I have often heard people talk but which I neither understand nor have ever made efforts to comprehend? And I have found no book that deals with the subject and makes apprehension easier?

Shareholder: I really must say that you are an ignorant person, friend Greybeard, if you know nothing of this enigmatic business which is at once the fairest and most deceitful in Europe, the noblest and the most infamous in the world, the finest and the most vulgar on earth. It is a quintessence of academic learning and a paragon of fraudulence, it is the touchstone for the intelligent and a tombstone for the audacious, a treasury of usefulness and a source of disaster, and finally a counterpart of Sisyphus who never rests and also of Ixion who is chained to wheel that turns perpetually.

Philosopher: Does my curiosity not deserve a short description from you of this deceit and a succinct explication of this riddle?

Merchant: That is my wish also, because the importunities of instructions, the shipment of goods, and the circulation of bills of exchange are all so burdensome to me. This load of work leads me to look for another means of acquiring a fortune and, even at the risk of loss, to slough off these many wearisome activities.

Shareholder: The best and most agreeable aspect of the new business is that one can become rich without risk.”

Luckily, we do not have to rely solely on the insights of the “Shareholder” today as mankind has in fact managed to produce a few “books that deals with the subject and makes apprehension easier” in the period since 1688. One of my favorites is Howard Marks’ ‘The Most Important Thing – Uncommon Sense for the thoughtful investor’.

In the book he states the following; “The two main risks in investing are; the risk of losing money and the risk of missing opportunity. It’s possible to largely eliminate either one but not both.“ As investors sit on our newly formed “permanently high plateau” surveying the landscape and ponder our next moves that conundrum weighs heavy on the mind.

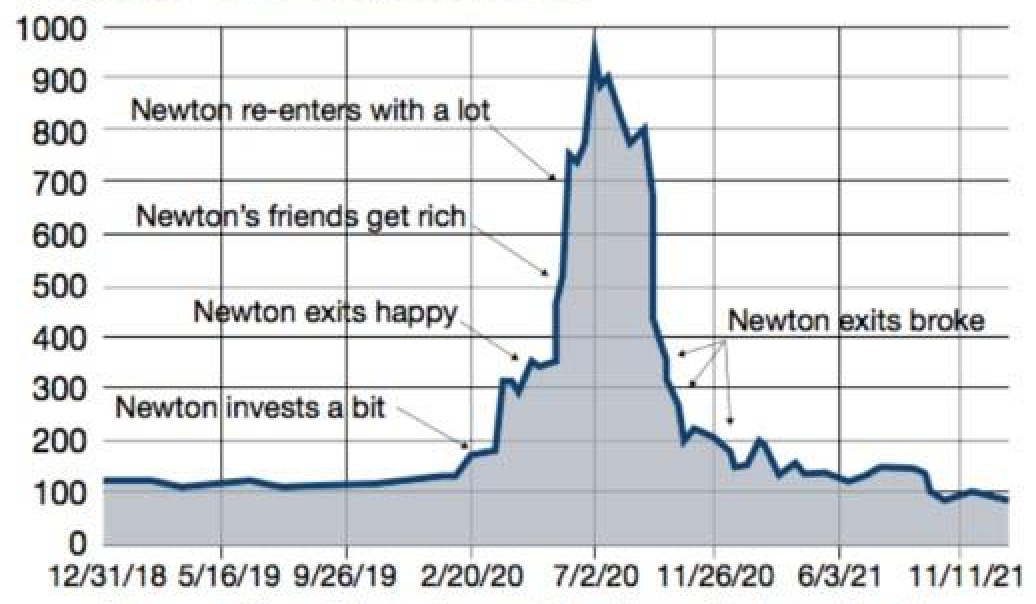

In the years 1718 to 1721 another “Philosopher,” Sir Isaac Newton, was drawn to the promise and mystery of the stock markets, this time the infamous South Sea Bubble and the London Stock Exchange. Sir Newton was by all measures a genius and has a Wikipedia page to kill for, it starts as follows; “Sir Isaac Newton was an English mathematician, physicist, astronomer, theologian, and author (described in his own day as a “natural philosopher”) who is widely recognised as one of the most influential scientists of all time and as a key figure in the scientific revolution.” Yet this great man, who could calculate the motions of the heavenly bodies, was found desperately wanting when it came to understanding the ‘madness of people’. In the Benjamin Graham’s 1949 classic book ‘The Intelligent Investor’ he writes; “Back in the spring of 1720, Sir Isaac Newton owned shares in the South Sea Company, the hottest stock in England. Sensing that the market was getting out of hand, the great physicist muttered that he ‘could calculate the motions of the heavenly bodies, but not the madness of the people.’ Newton dumped his South Sea shares, pocketing a 100% profit totaling £7,000. But just months later, swept up in the wild enthusiasm of the market, Newton jumped back in at a much higher price — and lost £20,000 (or more than $3 million in [2002-2003’s] money. For the rest of his life, he forbade anyone to speak the words ‘South Sea’ in his presence.”

The South Sea Stock price & Sir Newton’s ill-fated journey. (Dec. 1718-Dec 1721).

Sources: Marc Faber, Jeremy Grantham, Sir Isaac Newton.

Sources: Marc Faber, Jeremy Grantham, Sir Isaac Newton.

The Fear Of Missing Out (FOMO) is alive and well today as we sit and ponder; what comes next? Is the terrain ahead an upward curve to even higher peaks? Is it a mirage? Is there a steep decline shrouded in the mist of greed and optimism? Time will tell. One lesson that students of history can heed is that it pays to be prepared for different outcomes.

In his book Howard Marks shares the 3 stages of bull and bear markets, they can provide a good framework for assessing where we are in the cycle at any given time.

The 3 stages of the bull market:

The 1st, when a few forward-looking people begin to believe things will get better.

The 2nd, when most investors realize improvement is actually taking place.

The 3rd, when everyone concludes things will get better forever.

The 3 stages of the bear market:

The 1st, when just a few thoughtful investors recognize that despite the prevailing bullishness, things won’t always be rosy.

The 2nd, when most investors recognize things are deteriorating.

The 3rd, when everyone’s convinced things can only get worse.

In his Memo titled; “Now What” from Jan. 10th 2008, Mr. Marks states; “For a bullish phase to hold sway, the environment has to be characterized by greed, optimism, exuberance, confidence, credulity, daring, risk tolerance and aggressiveness. But these traits will not govern a market forever. Eventually they will give way to fear, pessimism, prudence, uncertainty, skepticism, caution, risk aversion and reticence. Busts are the product of booms, and I’m convinced it’s usually more correct to attribute a bust to the excesses of the preceding boom than to the specific event that sets off the correction.”

We are in Terra Incognita as we would appear to be in suspended animation over a vast canyon stretching between the state of the real economy and the narratives driving the sentiments underpinning the financial markets. We have both an environment driven by greed, optimism, exuberance, credulity, risk tolerance and aggressiveness as well as one of tangible fear, pessimism, uncertainty, skepticism but the herd appears to have been pushed so far out of its intellectual comfort zone that good news have become bad news and vice versa. So, while fear and uncertainty are elevated the natural tendency for caution, risk aversion and reticence has been overridden and exuberance has reclaimed the throne after a sharp but brief absence earlier this year. Much of this is due to the centralization of the signals and flows in our markets over the last couple of decades. Central banks have become the driving force while Mr. Market has been served increasingly potent shots of spiked Cool-Aid. History informs us that such debasement of market principals can only go on for so long and tend to leave a lasting scar. Nature shows us that highly centralized systems can be efficient but fragile, and once the soothing calm surface is broken the waves of volatility are all the more devastating.

How to proceed to avoid the experience of Newton and so many others over the long arch of history?

The circularity of our financial history seems to indicate that while in areas such as science and math mankind can build lasting cumulative knowledge across generations, but in the more emotional arts such as matters pertaining to wealth, each generation are doomed to repeat the experiences of their ancestors. Going by the last couple of decades, one might even deduct that it is not so much ‘the same things happening to new people’ but the same things happening to the same people, who seems to have forgotten their experiences. This may not be a new phenomenon, in Confusion de Confusions it is observed that; “…it might be expected that, as the wound is fresh, there would be no new injury. But though the proverb “He who once is intoxicated…” condemns such goings-on, it seems emotion has greater power than the warning of proverbs; gullibility and seduction cannot in any way be prevented.”

To conquer our own instincts and the madness of crowds we must find ways to establish rules-based investment frameworks and ensure they are actually adhered to when the temptation to err is at the highest. Furthermore, a flexible approach is optimal. In Confusion de Confusiones the following description of the options market is provided, and it gives a solid reasoning for building margin for error and choice into your investment strategy; “The Dutch call the option business “opsies”, a term derived from the Latin word ‘optio’, which means choice, because the payer of the premium has the choice of delivering the shares to the acceptor of the premium or of demanding them from him respectively. Since the famous Calepino derives ‘optio’ or choice from ‘optare’, which mean wish, the correct etymology is shown here, because the payer of the premium wishes to choose that which appeals most to him and, in case of mis-judgement, he can always avoid that which he had at first wanted to choose…”

The lesson appears to be that a flexible approach is the optimal path. According to Darwin’s book; ‘Origin of Species’; “It is not the most intellectual of the species that survives; it is not the strongest that survives; but the species that survives is the one that is able best to adapt and adjust to the changing environment in which it finds itself.” Always ensure you have options and that you have the means to adapt to change. Better to bend than break when a storm blows in. These are lessons that are at the very core of our investment strategies at The Strategic Funds, our way is the All-Weather way…

Disclaimer

This piece (Strategic Thoughts) does not constitute an offer to sell, solicit, or recommend any security or other product or service by Strategic Capital Advisors or any other third party regardless of whether such security, product or service is referenced. Furthermore, nothing in this piece is intended to provide tax, legal, or investment advice nor should it be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction.

Sources: Bloomberg, Apollo.

Sources: Bloomberg, Apollo. Sources: Marc Faber, Jeremy Grantham, Sir Isaac Newton.

Sources: Marc Faber, Jeremy Grantham, Sir Isaac Newton.