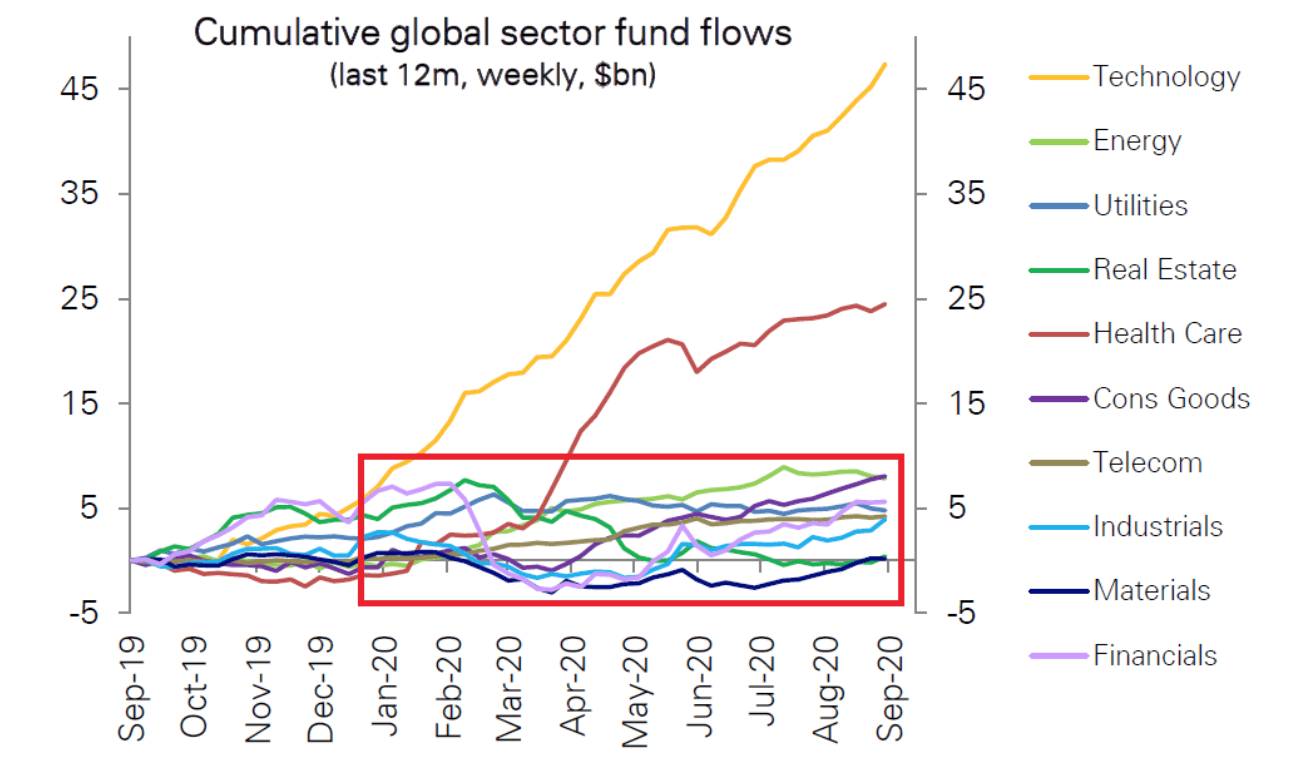

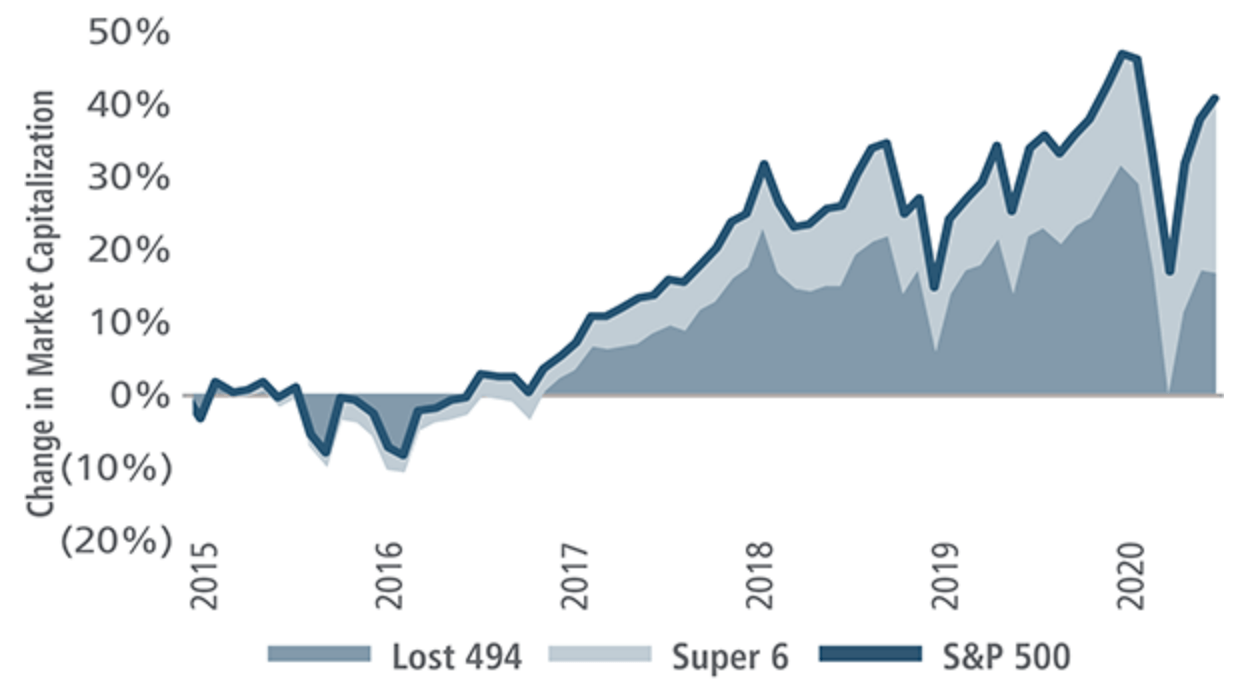

2020 has been a year of extremes and it feels like it has been the point of departure between the real economy and financial markets. A vast schism has opened up, the noise has reached new highs and whatever one’s outlook, there has been times during the year when markets appeared to echo your sentiments. Earlier this year in the space of just over two weeks, the US stock markets dropped from record highs into bear market territory. That is the fastest time between a new high and a bear market in history. The prior record was 42 days and it was set in 1929. It has since jumped back up to record highs while most economic indicators in the real economy are struggling. Even within the stock markets a dramatic fork in the road has appeared signaling an inherent flaw at the heart of the passive index mantra. Only a select few companies in tech and healthcare have been exploding to the upside while everything else is sinking deeper and deeper into the swampy waters of ‘zombies’ and ‘fallen-angels’. The S&P500 has become the story of the ‘super 6’ and the ‘lost 494’. Investors take note: Crocodile jaws tend to close.

A K-Shaped recovery has taken hold both in the real economy and within the main stock indexes. (Data as of 16-sep-2020)

Watch out the S&P500 is approaching the ‘breadth’ of a sharp blade…

(Growth of Market Value)

Developing All-Weather solutions…

Pessimism and optimism tend to overshoot as what signifies the actual extremes of both only become clear with hindsight in the aftermath. As an investor there is an edge in having a ‘Margin of Error’. The mathematician John Allen Paulos noted the following about complex systems; “Uncertainty is the only certainty there is. And knowing how to live with insecurity is the only security.” Instead of mapping and taking positions according to potential outcomes based on the features of the last crisis, it is more prudent to take inspiration from complex systems in nature and design processes that come with inherent adaptability and resilience that can alleviate a broad range of potential outcomes. Attempting to forecast an uncertain world and designing strategies for specific outcomes is a risky business. You all too often end up with a ‘map that does not match the territory’. Accepting and embracing uncertainty is a major step in the right direction. Risk can’t be eradicated, but it can be managed. When heading into unknown territory, best bring a toolbox of all-weather solutions.

Calm waters in the Cool-Aid pond…at least for now…

Markets in 2020 has been characterized by speculative bursts around unsustainable narratives. The current sentiments appear no different, investors in the main US indexes seems to have begun to look past the US election and other key macro trends, with the hope for a favorable low-risk outcome for early 2021 and have been positioning accordingly. Another more likely driver could be the belief that ‘bad news’ are indeed ‘good news’ in this weird upside-down world we inhabit, where investors pile into riskier and riskier assets as they see a ‘head I win, tails you lose’ type setup. The expectations being, that should the ‘eternal summer’ be rudely interrupted, central banks will be all knowing and able to unleash floods of stimuli at the exact time and place required to gently lift all boats to a ‘permanently higher plateau’ without any waves.

The last decade has seen a lot of poorly designed processes rewarded – in the economy and in financial markets. Many investors have gotten tipsy on the Cool-Aid and mistaken poor processes with good outcomes as a confirmation of their powerful intellect and found flimsy indicators to support their thesis akin to someone winning a round of Russian Roulette and thinking they have developed a sustainable model for building wealth. Hope and belief tend to be terrible risk management strategies.

Be Strategic…bring both the shield and sword into battle…

Whether you invest for your own book or is a trusted steward for others, it pays to bring both a shield and a sword to the battle. Living to fight another day is the very essence of compounding, and compounding is the cornerstone of building lasting wealth.

The Strategic Funds investment team focuses on developing All-Weather strategies built around adaptable and resilient processes. Our Contrarian 500 strategy, which has been operational since 2003, has significantly outperformed the S&P 500 during the last two major dislocations without sacrificing the upside during calmer weather. Combining our strategies with standard portfolio frameworks brings a tried and tested risk management component to the table.

As the conventional map may not accurately reflect the territory that we will be traversing in the coming years, best come prepared with the adaptable tools required for navigating all types of terrain and weather in your investing ‘toolbox’. Fortune favors the prepared.

Disclaimer

This piece (Strategic Thoughts) does not constitute an offer to sell, solicit, or recommend any security or other product or service by Strategic Capital Advisors or any other third party regardless of whether such security, product or service is referenced. Furthermore, nothing in this piece is intended to provide tax, legal, or investment advice nor should it be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction.