THE STRATEGIC PERSPECTIVE – WEEK OF FEB 26, 2021

Macro Trends:

In this week’s edition Sune Hojgaard Sorensen, our Director of Macro Research, takes a look at the confluence of long-term macro trends that is setting up strong demand dynamics for ‘new energy materials’ with a focus on Dr. Copper.

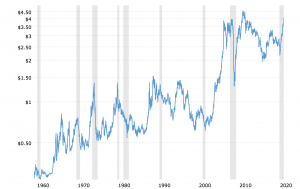

Dr. Copper is getting red hot…

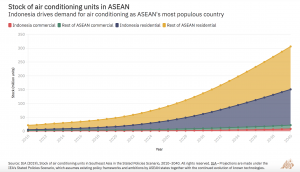

According to a recent article by the Kontinentalist, “Just 15% of households in ASEAN own an air conditioning unit, and it varies widely with income across the region. More than 80% of people in wealthier countries own an air conditioning unit. In less wealthy countries only 10% do. ASEAN’s cooling needs will surge with the region’s urbanisation and growing middle class. Household energy use in ASEAN is expected to rise by 64% by 2040 due to air conditioning alone. The International Energy Agency reported that by 2040, cooling will account for nearly a fifth of the region’s total energy needs and up to 30 percent of peak electricity demand (200 GW), if current and planned policies stay the same. Put in context, that’s all of Germany’s current electricity capacity.”

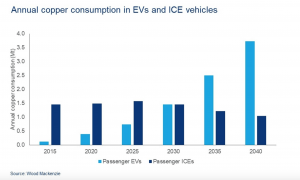

The air conditioner units alone involve lots and lots of copper and other commodities, then add in the need for smart grids & related infrastructure, the shift to EVs, according to Wood Mackenzie a fully electric bus uses between 11 & 16 times more than an ICE passenger vehicle, and it becomes clear that the trend is your friend in ‘new energy materials’.

Copper prices – 45 Year Historical Chart (Daily COMEX copper prices USD per pound).

Source: https://www.macrotrends.net/1476/copper-prices-historical-chart-data

Micro Moves:

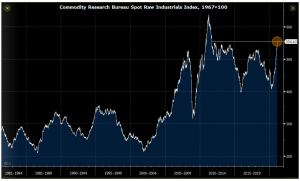

In this week’s edition, Nikolas Joyce, our Co-Chief Investment Officer, goes off the beaten track and looks for signs of inflation amongst the nontraded raw industrial commodities and by considering the Breakeven inflation rate. The signals are there amongst all the noise.

“If you do the work and take the time to look around the edges of things you can find the signs that inflation may be picking up, nontraded raw industrial commodities, which are not as subject to the influence of speculative traders, are at multi-year highs.”

Source: Bloomberg

“Additionally, the spread between 10-year US Treasuries and Inflation-indexed Treasuries, the so called Breakeven inflation rate is at multi-year highs. Higher and rising inflation tends to favor long volatility trading exposures. This is the territory for active investors with strong risk management capabilities”

Recommended content from our explorations this week:

The Buffett indicator at all-time highs: Is this a cause for concern? https://www.visualcapitalist.com/the-buffett-indicator-at-all-time-highs-is-this-cause-for-concern/

Evolution or revolution? The impact of a digital euro on the financial system https://www.bis.org/review/r210211d.pdf

The evolution of a special species:

https://www.noemamag.com/the-evolution-of-a-special-species/

What is the Circular Economy?

https://www.ellenmacarthurfoundation.org/circular-economy/what-is-the-circular-economy

A final thought…