THE STRATEGIC PERSPECTIVE – WEEK OF MAR 19, 2021

Macro Trends:

In this week’s edition Sune Hojgaard Sorensen, our Director of Macro Research, takes a look at the very real risks to the US economy and financial markets associated with extreme weather events.

“As security threats go, climate change is not the wolf at the door, threatening to blow the house down. Rather, it is thousands of termites whose individual impacts are small and hard to see, but whose collective impact is potentially just as catastrophic…”

– Cullen Hendrix, Texas National Security Review 2020

When looking at climate change and the associated risks as an investor it’s best to step away from the hysterics and the politics and look where real economic decisions are being made. In the here and now there are plenty of signs that our environment is in trouble with real implications for our economies and financial markets. The US Army Corp of Engineers has put out extensive work on Climate change and the US intelligence services has highlighted the global security risks driven by it.

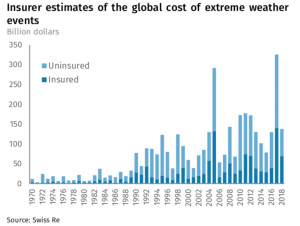

Dig into reports by major insurance companies and you will see real economic implications of extreme weather mentioned at increasing frequency. In 2017, the reinsurance company Swiss Re estimated that weather-related natural catastrophes around the world cost $326 billion, the highest year on record. This excluded the economic cost of a wide range of lower-profile extreme weather events.

Moodys has done extensive work on the issues of flooding and related costs to local & federal government. The US Commodity Futures Trading Commission (CFTC) recently put out a 196-page report on the implications of Climate risk to the US financial system. In it they state that:

“Climate change poses a major risk to the stability of the U.S. financial system and to its ability to sustain the American economy. Climate change is already impacting or is anticipated to impact nearly every facet of the economy, including infrastructure, agriculture, residential and commercial property, as well as human health and labor productivity. Over time, if significant action is not taken to check rising global average temperatures, climate change impacts could impair the productive capacity of the economy and undermine its ability to generate employment, income, and opportunity”

Climate change is here and exposing individual assets, industries, and entire regional economies to new risks. Heat waves, hurricanes, high tide flooding, and other extreme weather events have become more severe – and more costly. Investors need to understand and consider these physical climate risks, and their economic and market implications.

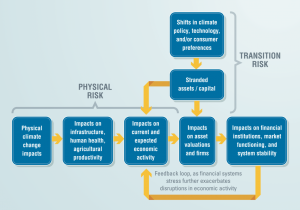

There are two main areas to consider:

Transition risks: The risks to businesses or assets that arise from policy and legal actions, technology changes, market responses, and reputational considerations as the international community seeks to slow the pace of climate change by transitioning to a lower-carbon economy.

Physical risks: The risks to businesses or assets emanating from changes in the climate that are already occurring and are projected to continue in the years ahead, under a range of different greenhouse gas emissions scenarios. These can be event-driven, such as increasingly intense and frequent storms, or related to chronic, longer-term shifts in precipitation and temperature.

The Relationship between Physical & Transition Risks

Source: CFTC

A central finding of the CFTC report is that climate change could pose systemic risks to the U.S. financial system. They state that; “Climate change is expected to affect multiple sectors, geographies, and assets in the United States, sometimes simultaneously and within a relatively short timeframe. As mentioned earlier, transition and physical risks—as well as climate and non-climate-related risks—could interact with each other, amplifying shocks and stresses. This raises the prospect of spillovers that could disrupt multiple parts of the financial system simultaneously. In addition, systemic shocks are more likely in an environment in which financial assets do not fully reflect climate-related physical and transition risks. A sudden revision of market perceptions about climate risk could lead to a disorderly repricing of assets, which could in turn have cascading effects on portfolios and balance sheets and therefore systemic implications for financial stability.”

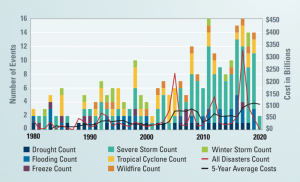

“As represented in the illustration below, the economic costs of disasters to the public and private sectors have been rising, as represented by the rising incidence of billion-dollar disasters. This is a function of greater exposure of cities, populations and assets, and the greater intensity and frequency of a variety of extreme weather events. Many of these extreme events are already attributable in varying degrees to climate change. For local governments, losses from such extreme events can have fiscal ramifications for many years.

US Billion-Dollar Disaster Events 1980-2020 (CPI-Adjusted.

Sources: CFTC, NOAA, National Centers for Environmental Information (2020)

Even without climate change, the United States needs to make significant investments in building new infrastructure and maintaining existing infrastructure. Climate change and extreme weather events add additional barriers of cost, time, uncertainty, and risk to these investments.

The real estate sector shares similar physical risks with the infrastructure sector. The real estate sector is not only dependent on infrastructure, it also generates local property tax revenue that supports most domestic infrastructure investment in the first place (Shi and Varuzzo, 2020). Since the value of real estate is closely linked to the value of the land it is built on, physical risks, such as wildfires and rising sea levels, can directly affect real estate prices.

Since most residential real estate in the United States is purchased with a mortgage, physical risk could also affect the underlying mortgages. Early-stage research suggests that wildfires and flooding cause increased residential mortgage default rates. Declines in mortgage values could affect financial market participants, including banks that hold these mortgages on their balance sheets, investors in mortgage-backed securities, and government-sponsored enterprises (GSEs), primarily Fannie Mae and Freddie Mac, which guarantee the default risk of the mortgages they securitize. Emerging evidence suggests that lenders are passing along riskier mortgages to the GSEs, in part, to remove risk from their own books. The federal guarantee of the GSEs suggests that U.S. taxpayers may ultimately be on the hook for prepayment and default risks associated with the impacts of physical risks on collateral values.

As of March 2019, properties in New York, Houston, and Miami—cities that are highly vulnerable to climate change-exacerbated flooding because of sea-level rise and more intense storms—alone made up one-fifth of CMBS properties by market value in the Bloomberg Barclays Aggregate Index (BII, 2019).

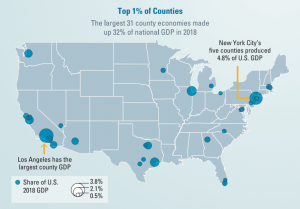

The Spatial Concentration of US GDP is coastal and in high-risk areas from climate change

Sources: CFTC, Bloomberg, Bureau of Economic Analysis (2020)

Another example involves the $3.8 trillion municipal bond market, made up of debt issued by U.S. municipalities. It provides crucial financing to local governments, including for infrastructure (MSRB, 2019). As shown in Figure 3.5, mutual funds, banks, and insurance companies hold a majority—about 55 percent—of municipal bonds, with households and non-profit organizations holding most of the rest.

Hurricanes, floods, and other disasters are already affecting the economies of issuing municipalities, and that risk is expected to grow. One analysis calculated that within a decade, if significant climate action is not taken, more than 15 percent of the current S&P National Municipal Bond Index by market value will be issued by cities suffering likely yearly economic losses of 0.5 percent to 1.0 percent of GDP. By the end of the century, close to 40 percent of the index would be issued by cities facing 3 percent or more of yearly GDP losses because of climate-related impacts (BII, 2019). Also, climate impacts could be even more devastating to municipalities in the aftermath of the COVID-19 pandemic, which likely will weaken the fiscal condition of many state and local governments. Climate-related losses could impair municipalities’ ability to service their obligations and lead to downgrades and eventually defaults and losses for municipal debt holders.”

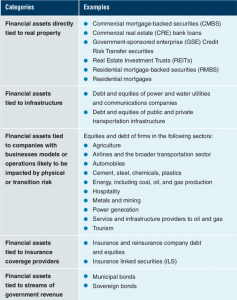

Categories of Assets Exposed to Climate Change Impacts.

Source: CFTC

Investors take note: The risks are real make sure you are factoring them into your thinking – now and in the future.

Micro Moves:

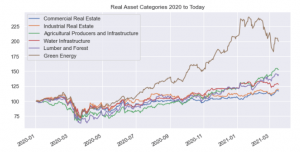

This week our CIO Nikolas Joyce ‘gets real’ with a look at real asset categories, some of which may be affected by the risk factors outlined in the prior segment.

The ‘real asset’ space is a key opportunity from a larger fiat currency debasement perspective, and some categories could also be positively affected from the major infrastructure spending that is likely to form the bulk of future government fiscal measures. Long-term demographic trends are also very supportive. All-in-all it’s a key area to keep an eye on from both a risk and opportunity perspective and one that I and the team have been exploring.

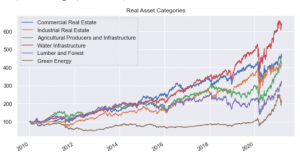

In order to share some perspectives on the space I have taken six real asset-themes and extracted the names that reoccur in ETFs in the respective categories and the sub-sectors which are aligned with the major themes we monitor via equity and commodity futures markets.

Industrial Real Estate

Commercial Real Estate

Agricultural Producers and Infrastructure

Water Resources

Forrest Resources

Green Energy

I have created six equally weighted indexes to represent the different opportunities across these areas.

This general overview shows the relative performance since 2010.

Source: TSF Research.

In recent periods the ‘Green Energy’ and Agriculture themes have been leading.

Source: TSF Research.

Clearly there are real opportunities in real asset related strategies that investors should consider and explore, as always an active risk management framework should be a part of the solution. We will continue our work in this space and any Accredited Investors who are interested in learning more should feel free to reach out for further conversations.

Recommended content from our explorations this week:

A look at how wealthy people in China attempt to circumvent capital exchange controls including via digital currencies:

https://www.bloomberg.com/news/articles/2021-03-11/from-crypto-to-offshore-accounts-tactics-used-to-get-cash-out-of-china?srnd=premium-asia&sref=vllWFA1z

A look at how EM markets have increasingly become a double allocation to “growth” over “value”:

https://allstarcharts.com/evolution-of-em/

A look at how the world has changed 1 year in to the Covid-19 pandemic from an economic standpoint and some key trends to explore:

https://www.visualcapitalist.com/the-covid-19-pandemic-one-year-in/

A pragmatic look at Bitcoin and Crypto:

https://thelykeion.com/bitcoin-foundations-without-tribalism/?utm_source=Lykeion&utm_campaign=8024c4bdf0-EMAIL_CAMPAIGN_2020_11_23_05_02_COPY_01&utm_medium=email&utm_term=0_2d8d01337f-8024c4bdf0-358391696

A final thought…