THE STRATEGIC PERSPECTIVE – WEEK OF MAR 5, 2021

Macro Trends:

In this week’s edition Sune Hojgaard Sorensen, our Director of Macro Research, takes a look at how the pandemic has fast-tracked longer-term trends and at the corporate level has exacerbated the strength of those companies that operate from strong foundations with a foot in the future and has painfully put a spotlight on the weaknesses of the more fragile. Investors best look beyond the index level as the ice is thin at the top and the waters below are riddled with Zombies and Fallen Angels.

Microsoft CEO Satya Nadella stated back in April of 2020 that; “We have had 2 years of digital transformation in 2 months.” James Manyika, chairman of the McKinsey Global Institute, recently said; “The last year’s clearly been K-shaped.” noting that MGI analysis found almost all of the “superstar” companies at the top of its rankings had become stronger in 2020. The group featured many technology and pharmaceutical companies, and that most of its members had the global reach to ride out local Covid-19 waves. These “Superstars” had also typically invested more in the digital tools which became critical as employees and customers scattered. Even within sectors, “the variations between the most and least digitised companies were huge”, Mr Manyika said. From retailers forced to step up their ecommerce offerings to banks needing to move more transactions online, “the digitally enabled ones were ready for this moment”.

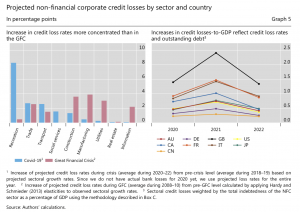

This illustration from the Q1 2021 BIS Quarterly Review clearly shows these trends play out in the global corporate credit space.

Living in a Superstar economy…

Back in 2018 McKinsey Global Institute analyzed nearly 6,000 of the world’s largest public and private firms that together made up 65% of global corporate pretax earnings. The conclusion clearly showcased the trend towards a so-called; “Superstar economy” with economic profits distributed along a power curve with the top 10% of firms capturing 80% of economic profit among companies. The middle 80% of firms recorded near-zero economic profit. The top 1% by economic profit accounted for 36% of all economic profit for companies with annual revenues greater than $1bln. According to the same study, the gap between “superstar firms” and median firms has widened over the past 20 years. The move towards a digital reality and the rise of the value of the intangible has no doubt been a key driver in this.

2020 has seen all these trends accelerate and the K-shaped reality – at corporate level and at the employment level – has only become more pronounced. In the MGI report they state; “…superstar sectors tend to have relatively higher R&D intensity and lower capital and labor intensity than other sectors do. The higher returns in superstar sectors accrue more to the corporate surplus rather than the labor surplus, flowing to intangible capital, such as software, patents, and brands. Although some superstar sectors have stronger multiplier effects on economic growth than declining sectors do, their gains are more geographically concentrated compared to sectors in relative decline. For instance, gains to internet and media activities are captured by just 10 percent of US counties, which account for 90 percent of GDP in that sector.”

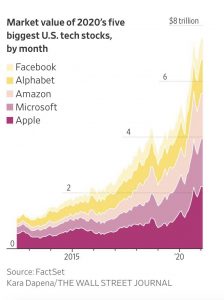

Here we can see these dynamics at play through the quarterly revenue changes from a year earlier for the ‘FAAAM’.

The FAAAM is doing ok…(Look out below though, large swaths of the US corporates are struggling to even service the interest on their historically high debts)

Micro Moves:

In this week’s edition, Nikolas Joyce, our Co-Chief Investment Officer, dives into these K-Shaped trends to identify how one can become a “Superstar Investor” in this K-Shaped reality.

“Clearly a K-shaped recovery will cause a different set of opportunities for firms that are part of the networked economy and diminished opportunities for firms that are on the lower leg of the K. There should be upward price pressure on the names that service the parts of the economy least affected by unemployment like employees in financial and information services — bankers, real estate agents, telecommunications professionals. There is an expectation of increased foreclosures among the less networked population.

So the K-shaped reality goes beyond the winners at the industry/company level but also has social and broader economic effects. The main challenge from a Global Macro and investing perspective is how policymakers will deploy stimulus when part of the economy is down and out and the other part is not in need of stimulus. A recent Bloomberg article provided the following summary: “The diverging strokes of the letter K represent the differing fortunes of the haves and have-nots following the deepest recession in decades. As joblessness surged and many households struggled to pay the bills, plenty of Americans were able to work from home and benefit from a sharp rise in asset values.Unprecedented stimulus from the Federal Reserve kept mortgage rates low and encouraged investors to buy equities. America’s richest people have seen their fortunes balloon.” Expect the government and central banks hand to become even more forceful in the economy and financial markets”

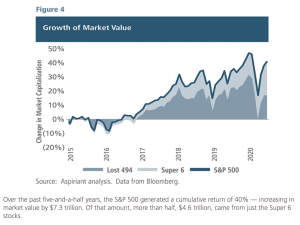

“Investors clearly have to think beyond the headline Index performance trends, the reality is that below the daily noise of “new highs” the dynamics are very different. This is not a new development, over the last five-and-a-half years, the S&P 500 generated a cumulative return of 40% – increasing in value by $7.3trln. However of that amount, more than half ($4.6trln) came from just the so-called ‘Super 6’(Facebook, Apple, Amazon, Netflix, Alphabet & Microsoft) while the ‘Lost 494’ drifted towards Zombie status or struggled to stay afloat in the middle.”

“As an investor you can jump on the bandwagon and keep allocating to this narrow section of the market, you can look to identify bargains amongst the ‘lost 494’, you can develop strategies that enables you to harness the schism and the volatility below the surface or you can look beyond the traditional indexes and spread your universe to include more asset classes and geographies. I am always working to develop so-called ‘All-Weather Strategies’, which means looking around the edges of things and designing multi-directional frameworks. Each investor will obviously have to consider their unique set of requirements, but having a plan and a set of solutions for harnessing volatility should certainly be a part of the mix for this decade.”

Recommended content from our explorations this week:

Get the full perspectives on the “Superstar Economy” via the original MGI report here:

https://www.mckinsey.com/featured-insights/innovation-and-growth/superstars-the-dynamics-of-firms-sectors-and-cities-leading-the-global-economy

Read our Strategic Thoughts piece on: Zombies and Fallen Angels which cover the dynamics discussed above in more detail:

https://www.thestrategicfunds.com.pr/a-journey-below-the-surface-swimming-with-zombies-fallen-angels/

Take a deep dive into ‘International banking and financial market developments with the BIS Quarterly Review here:

https://www.bis.org/publ/qtrpdf/r_qt2103.pdf

CITI takes a leap into the world of Bitcoin here: https://ir.citi.com/JrbQZw6ZuDGb19M7237byZdoVWxD1t6PsfdpH2hTGDszrRgg52q9SIii-YS7ddTEpFmXqSc0_wVX3vxwow8QZlzQoJbrREpr

A final thought…