LatAm Crypto Trends

Macro Trends:

In this week’s edition Jacob Shapiro, our Global Macro Adviser, takes a look at the adoption of crypto in Latin America and comes up with some interesting insights.

Latin America has been described in various media outlets as “the most crypto-friendly region” and one of “the fastest-growing crypto markets” in the world. It is surprising, therefore, to note that a recent study done by Chainalysis found that Latin America sent and received $25 and $24 billion cryptocurrency in 2020 – representing just 5 and 9 percent of global cryptocurrency activity in a given month. That is right in line with Latin America’s share of global population (around 8.4 percent).

True, the region does have the second-highest share of retail crypto activity by region, and true, a recent Visa survey found that 25 percent of credit card users in Latin America are eager to use cryptocurrencies. Stock market darling Mercado Libre is even letting customers buy real estate with bitcoin! Even so, professional traders still account for almost 80 percent of all volume. Of the top ten countries on Chainalysis’ Global Crypto Adoption Index, just two are located in Latin America, and one of them – Venezuela – is such a geopolitical basket case that it is impossible to generalize any insights from its inclusion.

LatAm – The under banked…

Source: https://data.worldbank.org/indicator/FX.OWN.TOTL.ZS?locations=ZJ&most_recent_value_desc=true

Coming in ninth on the list, however, is Colombia – and that is worth a little more consideration. According to the Chilean crypto exchange Buda.com, crypto trading volume in Colombia in the first three months of 2021 surpassed the entire volumed traded in Colombia in all of last year. Colombia’s percentage of the population that is unbanked has been steadily decreasing since 2015 – but 23 percent of Colombia’s roughly 50 million people still remain outside the formal financial ecosystem.

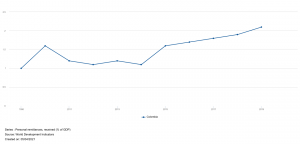

Colombia – Personal remittance trends…

Source: https://data.worldbank.org/indicator/BX.TRF.PWKR.DT.GD.ZS?locations=CO

In the past, crypto-adoption in Colombia has largely been tied to migrants looking to use digital currencies so they can more easily access and transfer remittances than they would otherwise be able to via traditional channels. In recent months, however, Colombians have had a different impetus to consider parking their assets into cryptocurrencies. Indeed, the socioeconomic fear driving the interest in cryptocurrencies boiled over in the form of protests and ultimately violent clashes between the people and Colombian military forces over the weekend.

The straw that broke the proverbial camel’s back was a tax reform proposal supported by President Iván Duque. Duque, who campaigned on a fairly vanilla, center-right populist platform in 2018, has been forced to do the unthinkable due to COVID-19. First, he rolled out a government financial support program called “Ingreso Solidario,” designed to provide direct support for Colombia’s 3 million poorest people. Then, with his tax proposal, Duque essentially proposed paying for those handouts with tax increases – precisely the opposite of what he promised as a candidate.

Duque’s decision was driven by Colombia’s worsening debt and government fiscal deficit. Indeed, S&P just affirmed a BBB- rating and a negative outlook for the country, and Moody’s views the implementation of Duque’s tax proposal as “decisive for Colombia’s rating.” So much for that – popular opposition to Duque’s proposed reforms forced him to withdraw the bill and perhaps even sacrifice his Minister of Finance as a scapegoat to the masses.

Which brings us back to Colombia as a potentially fast-growing market for cryptocurrency adoption. The Colombian government has taken note: an adviser to Duque recently told CoinDesk that the government “can’t stand by and do nothing.” As a result, regulators are issuing and enforcing crypto tax guidelines and anti-money laundering regulations. Colombia’s Superintendencia Financiera de Colombia also recently launched a year-long experiment that allows nine firms to deposit and withdraw resources on behalf of crypto platforms.

This is a clever move by the Colombian government – and a necessary one. The fact of the matter is, the violence observed in Colombia over the weekend is a warning sign that the Colombian government may not possess the power or authority to stave off a serious economic downturn and, in a worst-case scenario, a debt crisis. That is an obvious reason for Colombians to reconsider what they should do with their assets.

In that sense, the macro-story about Colombia is a microcosm of the broader crypto story in general, as the places where adoption can be most disruptive and revolutionary are also the areas where governments are so weak even they are looking to crypto as a hedge. As Baron Rothschild so famously once said: “the time to buy is when there’s blood in the streets.”

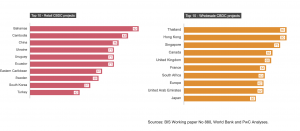

Our Crypto Market Analyst, Toa Lohe looks at the developments in CBDCs including the plans for Fedcoin.

Brian Arthur wrote in The Nature of Technology that; “money does not feel like a technology because “the monetary system makes use of the ‘phenomenon’ that we trust a medium has value as long as we believe that others trust it has value and we believe this trust will continue in the future. Notice the phenomenon here is a behavioral, not a physical one.” The behavioral response to bitcoin and nongovernmental virtual currencies has initiated discussions about trust. In fact, Nigerians trust bitcoin, a currency created “out of thin air,” more than fiat money in their wallets. Central banks around the world have responded to technological shifts by experimenting with central bank digital currencies (CBDCs). Even though the US Dollar is “the world’s reserve currency,” it doesn’t rank in the top 10 for CBDC projects. New developments are on the horizon. The Federal Reserve Bank of Boston and the Massachusetts Institute of Technology are researching a Fedcoin and plan to unveil their findings in July. The Digital Dollar Project will launch five US CBDC pilots over the next 12 months. The US Dollar “phenomenon” has gripped the world for decades but the Internet grants unbanked individuals’ access to other options. The US dollar must catch up with financial technology to remain the world’s reserve currency.

Source: https://www.pwc.com/it/it/publications/central-bank-digital-currencies-towards-global-adoption.html

Recommended content from our explorations this week:

- PayPal has held exploratory talks about launching a stablecoin: sources

https://www.theblockcrypto.com/post/103617/paypal-has-held-exploratory-talks-about-launching-a-stablecoin-sources - Micro Bitcoin Futures were launched by the CME this week

https://www.cmegroup.com/trading/micro-bitcoin-futures.html - The Intercontinental Exchange sold its stake in Coinbase for USD 1.2B.

https://s2.q4cdn.com/154085107/files/doc_financials/2021/q1/1Q21-Earnings-Presentation_vF.pdf