Winning the inflation game…

In our Strategic Thought piece titled; ‘Enter the (de)basement’ from December 2020 ( https://www.thestrategicfunds.com.pr/enter-the-debasement/ ) I wrote:

“The bad news: debasement is baked into the cake this decade…The good news: History is full of useful examples of how this tends to play out so investors can establish strategies that provide protection and even harness these strong forces…”

In a recent SSRN paper titled; ‘The best strategies for inflationary times’ the authors provide the following introduction:

“Given the unprecedented monetary and fiscal interventions, most agree that inflation risk has increased. As such, it is time that portfolio managers review their asset positioning in the face of this heightened risk.”

They go on to state some facts that investors should note;

“There has been an unprecedented increase in money creation. The US money supply (M2) has grown by $4.2 trillion, from $15.5 trillion to $19.7 trillion in one year (between February 2020 and February 2021). Second, there has been extraordinary fiscal accommodation. The Congressional Budget Office (CBO) estimates a US fiscal deficit of $3.1 trillion in 2020, or 15% of GDP. The CBO forecasts the deficit will shrink to $2.3 trillion in 2021, or 10% of GDP. In the entire modern history of the United States, there have only been two instances of consecutive double- digit deficit years.”

The paper shares some lessons from past inflationary episodes in US history for investors, here we will look at a few areas we consider to be interesting sources of both potential protection and outperformance for investors in the decade ahead.

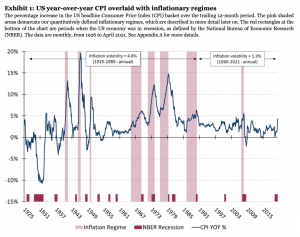

The long view – US CPI…

Source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

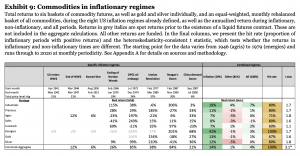

Commodities have been consistent winners during inflationary periods during the last century. The paper finds that; “traded commodities have historically performed best during high and rising inflation. In aggregate, they have a perfect track record of generating positive real returns during our eight US regimes, averaging an annualized +14% real return. This contrasts with normal periods when the commodity aggregate returns low single digits.”

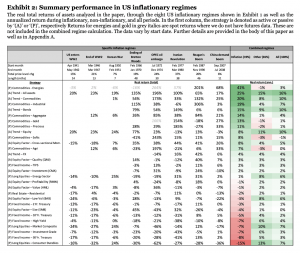

Overview of the performance of different assets during US inflationary periods.

Source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

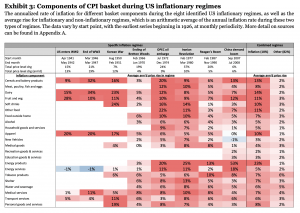

A peek inside the CPI basket during times of inflation can be revealing…

Best have the Commodities…

Source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

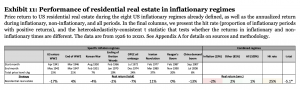

Residential Real Estate has been sub-optimal across most of the inflationary episodes…

Source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

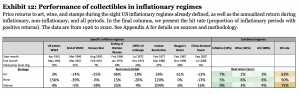

While Collectibles like art and wine has done well…

Source: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3813202

We appear to be way beyond the point of no return for both corporate and especially public debt levels. History shows us that currency debasement is the path of least resistance. In our view hard assets and innovation driven strategies are the places to focus your attention for the path ahead – That is the Strategic way…