Reading for the path ahead – Volume 2: Getting Exponential.

A 2 Vol series covering two books with powerful ideas investors need to think about for this decade and beyond…

In the 1st leg of this mini-series (Read it here) I made the point that we have moved on from living in “Financial times” to something that feels more like “Political Times”. As I worked on this piece, I started to think we perhaps live in “Technological Times” and that many of the political and social actions we see are in fact largely reactions to the confluence of exponential technological forces that have begun to reach all areas of our lives.

In this month’s edition I cover an insightful book to help us explore this further. It’s the book; ‘Exponential – How accelerating technology is leaving us behind and what to do about it.’ by the great synthesizer, Azeem Azhar. It’s a sweeping exploration of innovation, technology and the powerful trends that has led us to the position we find ourselves in today. You should put it under the Xmas Tree of all the people you hold dear including yourself.

I will look through the lens of an investor or an entrepreneur and focus on the insights the book provides into the nature of technological innovation and the more recent leaps we have seen in what Azeem describes as; Exponential Technologies and the companies that has been able to harness them.

Key Takeaway #1: Our age is defined by the emergence of several new ‘general purpose technologies’, each improving at an exponential rate. It’s a story that starts with computing – but also encompasses energy, biology and manufacturing. The breadth of this change means that we have entered a wholly new era of human society and economic organization – what Azeem calls the ‘Exponential Age’.

Key Takeaway #2: “The Exponential Age is a near-inevitable consequence of human ambition.”

What follows are my key takeaways that speaks to these developments along with my thoughts.

“The conclusion to all this research has led me to is deceptively simple. At heart, the argument of Exponential has two key strands.

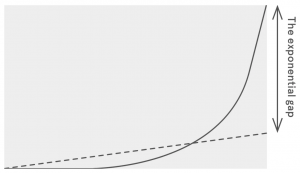

First, new technologies are being invented and scaled at an ever-faster pace, all while decreasing rapidly in price. If we were to plot the rise of these technologies on a graph, they would follow a curved, exponential line.

Second, our institutions – from our political norms, to our systems of economic organization, to the ways we forge relationships – are changing more slowly. If we plotted the adaption of these institutions on a graph, they would follow a straight, incremental line.

The result is what I call the ‘Exponential gap’. The chasm between new forms of technology – along with the fresh approaches to business, work, politics and civil society they bring about – and the corporations, employees, politics and wider social norms that get left behind.”

Mind the Exponential Gap: Linear institutions meets Exponential Technologies.

Source: Azeem Azhar.

Any student of history will have come to the conclusion that technological innovation is the consistent driver of dramatic changes in human history, when we uproot the status quo, break away from the linear and cast away the constraints of the more permanent forces of geography and demographics. It’s at such times that great fortunes are made and lost. Azeem speaks eloquently to this unpredictable driver of change here: “…the technologies we build can take society in unexpected directions. When a technology takes off, its effects can be enormous, stretching across all areas of human life: our jobs, the wars we fight, the nature of our politics, even our manners and habits. To borrow a word from economics, technology is not ‘exogenous’ to the other forces that define our lives – it combines with political, cultural and social systems, often in dramatic and unforeseen ways. The unpredictable ways that technology combines with wider forces – sometimes moving slowly, sometimes causing rapid and seismic transformations – are what makes it so difficult to analyze.”

Then we explore the past leaps and why today may be different: “In the early twenty-first century, the defining technologies of the industrial age are metamorphosing. Our society is being propelled forward by several new innovations – computing and artificial intelligence, renewable electricity and energy storage, breakthroughs in biology and manufacturing. These innovations are improving in ways that we don’t yet fully understand. What makes them unique is the fact they are developing at an exponential pace, getting faster and faster with each passing month. As in previous periods of rapid technological change, their impact is felt across society – not only leading to new services and products, but also altering the relationship between old and new companies, employers and workers, city and country, citizens and the market. Complexity scientists refer to moments of radical change within a system as a ‘phase transition’. When liquid water turns into steam, it is the same chemical, yet its behavior is radically different. (…) A phase transition has been reached, and we are witnessing our systems transforming before our very eyes. Water is becoming steam.”

“I argue that our age is defined by the emergence of several new ‘general purpose technologies’, each improving at an exponential rate. It’s a story that starts with computing – but also encompasses energy, biology and manufacturing. The breadth of this change means that we have entered a wholly new era of human society and economic organization – what I call the ‘Exponential Age’.”

“State-sized companies are on the rise – and they are challenging our most basic assumptions about the role of private corporations. Markets are metastasizing across ever-greater swaths of the public sphere and our private lives. Our national conversations are increasingly conducted on privately owned platforms, intimate details about our innermost selves are bought and sold online, thanks to the emergence of the data economy, and even the way we meet friends and form communities has been turned into a commodity.”

“During the Exponential Age, technology-driven companies tend to become bigger that was previously thought possible – and traditional companies get left behind. This leads to winner-takes-all markets, in which a few ‘superstar’ companies dominate – with their rival spiraling into inconsequentiality. An exponential gap emerges – between our existing rules around market power, monopoly, competition and tax, and the newly enormous companies that dominate markets.”

Exploring exponential technology…

“Exponential growth refers to an increase that compounds consistently over time. Whereas a linear process is what happens to your age, increasing by a predictable one with each revolution of the earth around the sun. The compounding starts slow – it’s even slightly boring. But at some point, the curve turns upwards and starts to take off. From this point onwards, the value leaps higher at a dizzying pace.

“I define an exponential technology as one that can, for roughly a fixed cost, improve at a rate of more than 10% per year for several decades. (…) A 10% compounding improvement in the price and performance of a technology would result in it becoming more than 2.5 times more powerful for the same price every 10 years. Conversely, the cost would drop by more than three-fifths for the same level of performance. A decade is only two traditional business cycles. (…) The second part of my definition is also crucial. For a technology to be exponential, this change should hold true for decades – and not just be a short-lived trend. (…) The computer chip business – with its roughly 50% annual improvement over five decades – certainly qualifies.”

“There are two sides to this phenomenon: decreases in price, and increases in potential. As the price of a technology drops, it starts to crop up everywhere. Industry can suddenly afford to bundle exponential technologies into new products. Humans first put chips into specialist devices bought by the military and space agencies, and then into mini-computers only affordable for the largest companies. Desktop computers followed a decade later, and as chips go cheaper and smaller, they were put into phones. At the same time the power of the technology explodes. The capabilities of a typical smartphone – high-definition color video, high-fidelity sound, fast-action video games, scanners that transcribe text – were not available to anyone, not even the richest countries, just a couple of decades ago. When technologies develop exponentially, they lead to continually cheaper products which are able to do genuinely new things.”

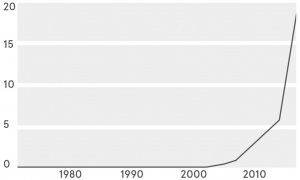

Getting Exponential via the example of the mighty semi-conductor…

Between 1971 and 2015, the number of transistors per chip multiplied nearly 10 million times. Making computing exponentially faster and cheaper, this has been the driving force for the broader leaps in our economies and societies.

Getting more with Moore’s Law: Transistors per microprocessor (billions).

Source: Azeem Azhar.

“Think of the first electronic computer, executing Alan Turing’s code breaking algorithms in 1945. A decade later, there were still only 264 computers in the world, many costing tens of thousands of dollars a month to rent. Six decades on, there are more than 5 billion computers in use – including smartphones, the supercomputers in our pockets.”

Our economy and society increasingly function and is built upon these computers and the network effect created by them via the internet.

However, the power of exponential technology is not purely a semiconductor driven phenomenon, renewable energy is at its core technology driven and as Wright’s Law (We learn by doing and as we scale so does the improvements to our processes) kicked in we have already seen exponential improvements. Here we explore solar power as an example (wind and battery tech also exhibits these dynamics).

“…generating any useful amount of electricity from the sun’s rays was simply too expensive. In 1975, a silicon photovoltaic module – the shiny reflective substrate you now see adorning solar farms around the globe- cost about $100 per watt of power it could produce. At that price, solar power would remain an energy source for low-energy playthings and government gadgets, and little else. Satellites had been festooned with solar panels – which were lighter than chemical batteries – since 1958. (…) The calculus has changed. Between 1975 and 2019, photovoltaics dropped in price some 500 times – to under 23 cents per watt of power. The bulk of that change has come in the last decade. Even in 2010, it cost 30-40 cents to produce a kilowatt-hour of electricity using solar panels making it 10-20 times more expensive than fossil fuels. But the cost of solar power has been declining at exponential rates – about 40% per annum for large commercial contracts. By October 2020, the cost of generating electricity from large-scale solar power, as well as from wind, had dropped below the cheapest form of fossil fuels product; combined-cycle gas generation. In the decade up to 2019, the price of electricity generated by solar power had declined by 89%. The story of solar power since the 1970s reveals that exponentiality is not limited to computing.”

The Exponential Age: Going horizontal and vertical with GPTs…

“These wide-ranging inventions are known as ‘general purpose technologies’ (GPTs). They may displace other technologies and create the opportunity for a wide variety of complimentary products – products and services that can only exist because of this one invention. Throughout history, GPTs have transformed society beyond recognition. Electricity drastically altered the way factories work and revolutionized our domestic lives. GPTs upturn our economies, and our societies too – spawning changes far beyond the sectors in which they began. We are witnessing the emergence of a transformative new wave of GPTs. Not a single GPT, as in the time of the printing press. Nor even three GPTs, like in the early twentieth century’s offering of the telephone, the car and electricity. In the Exponential Age, we’re experiencing multiple breakthrough technologies in the four broad domains of computing, energy, biology and manufacturing.

“Our age is defined by the cascading of technologies: one technology leads rapidly on to the next, and on to the next.”

“The General Purpose Technologies of the Exponential Age are not only improving at exponential rates, they are also combining in novel and powerful ways. Today’s GPTs riff off each other in unpredictable, constantly shifting patterns. And as these novel uses of technology are pioneered, they help other technologies evolve in fresh directions.”

“Exponential technologies are being driven by three mutually reinforcing factors – the power of learning by doing, the increasing interaction and combination of new technologies, and the emergence of new networks of information and trade.”

Getting ahead in the Exponential Age…

“In the Exponential Age, one primary input for a company is its ability to process information. One of the main costs to process that data is computation. And the cost of computation didn’t rise each year; it declined rapidly. (…) In general, if an organization needs to do something that uses computation, and that task is too expensive today, it probably won’t be too expensive in a couple of years. For companies, this realization has deep significance. (…) Even if those futuristic activities were expensive now, they would become affordable soon enough. Organizations that understood this deflation, and planned for it, became well-positioned to take advantage of the Exponential Age.”

“At the heart of Amazon’s success is an annual research and development budget that reached a staggering $36bln in 2019, and which is used to develop everything from robots to smart home assistants. This sum leaves other companies – and many governments – behind. It is not far off the UK government’s annual budget for research and development. The entire US government’s federal R&D budget for 2018 was only $134bln. (…) Perhaps more remarkable is the rate at which Amazon grew this budget. Ten years earlier, Amazon’s research budget was $1.2bln. Over the course of the next decade, the firm increased its annual R&D budget by about 44% every year.”

“…linear thinking, rooted in the assumption that change takes decades and not months, may have worked in the past – but not anymore. Amazon understood the nature of the Exponential Age. The pace of change was accelerating; the companies that could harness the technologies of the new era would take off. And those that couldn’t keep up would be undone at remarkable speed. (…) The companies, institutions and communities that can only adapt at an incremental pace. These get left behind – and fast.”

The exponential business model…

“Exponential technologies seem to imbue companies with powers that allow them to defy the force of gravity that held back firms of earlier generations. Economists call this new type of firm the ‘superstar company’. The superstar company rises rapidly, seemingly unburdened by the forces that hold traditional firms back. It seems to be more productive, more aggressive, more innovative, and able to grow faster. It dominates markets that already exists and creates markets that didn’t exist before. Superstar firms get bigger and bigger, dominating one market, the next. Many superstar firms are household names – Apple, Google, Uber, Facebook, Amazon. They transform the markets they inhabit, turning them into fertile ground for themselves and parched deserts for their competitors.”

“Wherever there are network effects, there is the chance of a winner-takes all market. Once a company has established itself as the market leader, it becomes extremely difficult to challenge it. And this effect is being driven by the consumers themselves. It is in the consumers’ own interest to join the biggest network – it is there, after all, that they will get the most value.”

“The growth potential of these companies is turbocharged further by another factor: platforms are incredibly capital-efficient. The platforms facilitate an exchange without actually having to spend any (or much) money. The world’s largest cab company, Uber, owns no cabs and employs no drivers. Airbnb hosts more overnight guests than any hotel chain, yet owns no hotels. Alibaba is the world’s largest online showroom for businesses, yet holds no stock.”

“From this heady combination of network effects and platforms, it becomes possible to make out the contours of the exponential corporation.” The ‘exponential corporation’ is a powerful nation-sized economic machine, and it is very profitable for its founders and investors as this statistic clearly shows: “About 10% of the world’s public companies create four-fifths of all company profits.”

Getting the intangible benefits…

“The software that runs Google’s search engine, the data that represents the network of friends in Facebook, the designs and brand identity of Apple, the algorithms that recommend your evening’s viewing on Netflix – this is where the true value lies. Economists call these non-physical assets ‘intangible’. The speed of the shifts to intangible assets has been remarkable. In 1975, about 83% of the market value of companies on the S&P500 stock market index was comprised of tangible assets. Intangible assets accounted for the remaining 17%. By 2015, those proportions had reversed. Only 16% of the S&P500’s value could be accounted for by tangible assets, and 84% by intangibles. This ratio skews even further when you look at the largest firms in the world: the exponential superstars. In 2019, the book value of the five biggest Exponential Age firms – Apple, Google, Microsoft, Amazon and Tencent – ran to about $172bln. But this measure emphasizes a firm’s tangible assets and largely ignores its intangibles. To figure out a firm’s book value you tally up a company’s cash, what is owed by customers and its physical assets, and then subtract its liabilities. The stock market valued those firms, at the time, at $3.5trln. In other words, traditional assets represented only 6% of what the market thought these companies were worth – their intangibles assets were doing the rest of the work.”

AI, the ultimate intangible asset, rides the data network effect…

“The tendency of intangible assets to help companies scale reaches its zenith when a business is drawing on artificial intelligence. AI is the ultimate intangible asset, because it takes on its own momentum – the algorithms give you more and more value without having to do very much. (…) This is another type of network effect – the ‘data network effect’, defined as ‘when your product, generally powered by machine learning, becomes smarter as it gets more data from your users. Take Google. You might ask why the search engine is so dominant. It wasn’t the first to market: that accolade likely goes to WebCrawler, a search index founded in 1994. Google was however, the first search engine that effectively captured data network effects.”

The opportunity of harnessing exponential technologies is clear and proven and investors should take note as many of these major leaps are still only getting started and the confluence of all these powerful dynamics will sow the seeds of new technologies and use cases that will bring further bounty for those who can tune out the noise and see the forest for the trees.

I will conclude with a few risk factors (beyond the obvious one of getting stuck with the linear) that investors should consider. As the quote below explores, the Exponential Gap leads to extreme tension within industries, economies and societies. Creative destruction still involves destruction and history shows that the battle between the status quo and the future can lead to extended periods of deep uncertainty and sharp volatility in ‘the shadowy world of the in-between’ as the powerful forces of the past and the future collides.

“The gap between our institutions’ capacity to change and our new technologies’ accelerating speed is the defining consequence of our shift into the Exponential Age. On the one side, you have the new behaviors, relationships and structures that are enabled by exponentially improving technologies, as well as the products and services build from them. On the other, you have the norms that have evolved or been designed to suit the needs of earlier configurations of technology. The gap leads to extreme tension. In the Exponential Age, this divergence is ongoing – and it is everywhere.”

It should also be noted that mankind tends to deploy its new technologies not just for games and for financial reward but also in the more consequential and damaging fields of warfare and conflict. Azeem touches upon this in the paragraph below – much of this is already playing out and it leaves us with more uncertainty and risk, not less.

“…exponential technologies are rewiring trade, conflict and the global balance of power. Here, two great shifts are underway. The first is a return to the local. New innovations alter the way we access commodities, manufacture products and generate energy – increasingly, we will be able to produce all three within our regions. If the story of the industrial age was one of globalization, the story of the Exponential Age will be one of re-localization. The second is the transformation of warfare. As the world gets re-localized, patterns of global conflict will shift. Nations and other actors will be able to make use of new adversarial tactics, from cyber threats to drones and disinformation. These will dramatically reduce the cost of initiating conflict, making it much more common. A gap will emerge between new, high-tech forms of attack and societies’ ability to defend themselves.

The Exponential Age is clearly upon us – within it the answer to most of our global challenges can be found as well as the seeds of destruction for what we have already build. We are heading into a period of flux and the outcomes are not clear nor guaranteed.

In 1898 Adolphe Rette wrote: “We are living in a storm where a hundred contradictory elements collide; debris from the past, scraps from the present, seeds of the future, swirling, combining, separating under the imperious wind of destiny.” It feels apt as I look out and survey the world today.

I think the two books I have shared in this series, Marko Papic’s ‘Geopolitical Alpha’ and Azeem Azhar’s ‘Exponential’ provides investors and entrepreneurs with a starting point for beginning to make sense of the swirling forces on the path ahead and at The Strategic Funds we are always glad to share our perspectives with our fellow travelers so please feel free to reach out. The world, like most other objects, is best understood if viewed from different vantage points.