Reading for the path ahead

A 2 Vol series covering two books with powerful ideas investors need to think about for this decade and beyond…

At the risk of getting into trouble with our wonderful legal and compliance team I will be sharing a guaranteed investment tip here from Mr. 100-Dollarbill himself AKA Benjamin Franklin; “An investment in knowledge pays the best interest.” Having shared that certain path to a wealth of knowledge, I will continue to enrich you by (air)dropping some thoughts on two books that I have read and re-read this year and feel provides investors with some great insights for mapping out the key risks and opportunities along the path ahead.

Throughout most of the last 3 decades, the Financial Times caught the zeitgeist with their ad; “We live in Financial Times”, in the last 5-6 years it seems we have transitioned into a ‘We live in Political Times’ era.

For the first edition in this two-part series, I will share a book that speaks to this transition eloquently and with applicable insights and thought frameworks. In my opinion it will serve investors – private and institutional – well to ponder its lessons as they seek to sketch out the paths ahead and allocate probabilities to them. The book is called; ‘Geopolitical Alpha: An investment framework for predicting the future’ by the indomitable Marko Papic,

Key Takeaway #1: “Most Voters Are Not Savers…” Think about what that means…

Key Takeaway #2: “Preferences are optional and subject to constraints, whereas constraints are neither optional nor subject to preferences.”

Below are some perspectives from Marko that I have been pondering and believe investors and entrepreneurs will be best served by considering:

Marko shares many great stories and his experiences as well as thought framework for analyzing complex systems. One that I feel is especially relevant is the concept of the Median Voter Theory (MVT). As with most things, it’s a case of ‘Standing on the shoulders of Giants’, MVT is not new – it was developed in the 1950s and is one of the few codified theories of political science. As Marko outlines it in the book; “It posits that to win an election or stay in power, parties and politicians approximate the policy choices of the median voter. It’s useful as a tool for sketching out political constraints. Another way to think of the ‘median voter’ is as an indicator of the political zeitgeist of a nation.”

It can be tempting to assign too much importance to the political rhetoric of incumbent or challenging politicians (all you have to do is read their Twitter feed) but as Marko outlines below, you are better served as an investor by focusing on the constraints the median voter places on whoever is in ‘power’ (more difficult to do as it involves actual analysis work – always remember the magic is in the work):

“The median voter is a more powerful indicator of market behavior than the individual policymaker’s preference. So to forecast policy, focus on the median voter, not the policymaker. If the median voter is shifting her preferences, it means that all parties, not just those in power, will respond and shift toward the median voter.”

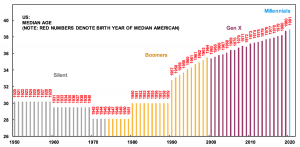

In our Strategic Perspective piece titled; ‘A silent paradigm shift: The future belongs to the women and the young folks’ I outlined how In 2017 we crossed a threshold with over 50% of the US population having been born after 1981 – Millennials and Gen Z became the majority. In the 2020 elections they were a larger block of potential voters than the Boomers for the first time. The “Median Voter” in the US is changing to the younger demographics this is a broad and powerful paradigm change that will reverberate across society, the economy, financial markets and policy – foreign and domestic. I highlighted that:

“When the majority of the electorate is facing heavy debt burdens, the uncertain employment formats of the so-called Gig-Economy, and has only a sliver of the wealth pie, it seems certain that these newly empowered groups will be looking to address these issues. They will do this by electing people who will hasten a broader wealth transfer through fiscal and tax policies that favor their group. This means more debt and as a result debt monetization.”

The Median American is now a Millennial…

Source: Clocktower Group Report: The steep wall of worry Buenos Aires & US Census Bureau. Note: Values for 2019 and 2020 are forecasts based on the 1990-2018 trend.

On these forces, Marko shares the following poignant insights in his book that investors best heed as they look to position for the decade underway:

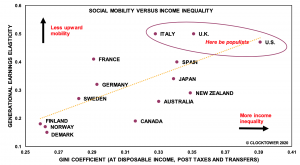

“The American voter is on a journey of a major ideological pendulum swing. But it is unclear whether this switch will spur a global momentum in the same direction. The US continues to stand out negatively on measures of income inequality and social mobility as well as on measures of “middle class as percent of population.”

On the current trajectory, the US will float away from this chart…

Source: Clocktower Group Report: The steep wall of worry Buenos Aires & CORAK/OECD. Note: Generational earnings elasticity refers to the elasticity of the child’s earnings with respect to the parent’s. Higher elasticity means that the child’s earnings are highly dependent on the parent’s, implying low social mobility.

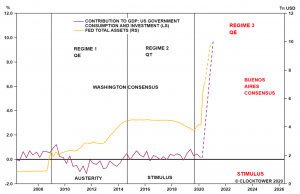

“The (Washington) Consensus was defined by a set of policies that sought to remove democracy from economic policy. Independent central banking, counter-cyclical fiscal policy, laissez-faire regulatory framework…all of these policies have a singular point in common: they remove the role of elected official from economic policy. (…) ..in the most enthusiastic adherents to the Washington Consensus – the US and the UK – the political pendulum is swinging back into populism. Democracy is finding its way back into economic policy.”

“The downside of the populist “growth above all else” mentality that the Buenos Aires Consensus* represents is that the US is likely to move further to the left on almost all economic dimensions. The net actions of American policymakers reflect the economic preference of the American media voter. If post-2016 policy shifts continue into 2020 and beyond, the US could be the first mover to spur global momentum away from laissez-faire policies – a transition away from the Washington Consensus toward the Buenos Aires Consensus. Such a shift would impact a wide swath of policies. Over the next decade, I would expect more unorthodox fiscal and monetary policy, an increase in antitrust cases, further fiscal easing, selective regulatory pressures, and higher taxes on both capital gains and high-income taxpayers.

The transition from the Washington to Buenos Aires Consensus will dominate markets over the next decade. This transition is more relevant (To investors) than the US-China geopolitical rivalry, risks to European integration, and technological change. All assets will be influenced by the deluge of fiscal and monetary policy. (…) The median voter is the price maker in the political marketplace, in the long-term politicians are mere price takers.”

Welcome to the Buenos Aires Consensus…

Source: Clocktower Group Report: The steep wall of worry Buenos Aires & Refinitiv Datastream.

*Marko’s definition of /reason for the “Buenos Aires moniker: “So why Buenos Aires? What does Argentina have to do with this populist backlash? Nothing other than that it has been the beset with decades of populist policymaking. And after its latest plunge back into populism following the 2019 election, what better city to replace Washington for our new catchall term than Buenos Aires?”

The path ahead…

Pondering Marko’s work made me think of this timeless quote from Bastiat back in 1848 as it speaks to the same dynamics: “The public has two hopes, and government makes two promises – many benefits and no taxes. Hopes and promises, which being contradictory, can never be realized.”

This was indeed the conundrum that has been the stone in the shoe of many regents, emperors and elected governments throughout history. Perpetual government debt and currency debasement has inevitably been the choice for bridging the gap between the ‘hopes and promises’. The Median Voter Abides. If the last decade has been an indicator of what’s to come on this front it would seem we are only just getting started or in the words of the epic Mark Hanna; “Those are Rookie numbers, you gotta pump those numbers up”.

Caveat Emptor – the flood is coming followed by a trip to the (de)basement…It’s a journey I explored in granular detail last year in this Strategic Thought: In the piece I go in search of a thought framework for defining the debt and debasement path.

Below is a section from the piece for your consideration:

“The problem with using history as a guide on currency debasement is that the mind jumps to the extremes, the spectacular – say Weimar Germany or Zimbabwe – these examples seems so far removed from the perceived realities in developed economies today. When you read Adam Fergusson’s seminal book on the subject; ‘When money dies – The nightmare of deficit spending, devaluation & hyperinflation in Weimar Germany’ paragraphs like the following etches itself in your mind; “In war, boots; in flight, a place in a boat or a seat on a lorry may be the most vital thing in the world, more desirable than untold millions. In hyperinflation, a kilo of potatoes was worth, to some, more than the family silver; a side of pork more than the grand piano. A prostitute in the family was better than an infant corpse; theft was preferable to starvation; warmth was finer than honor, clothing more essential than democracy, food more needed than freedom.” Yet it seems farfetched and like something that only happens to other people, in places far away or back in time. In truth the debasement risk that confronts most investors today is of a more slow and insidious kind.

The kind of inflation (debasement by another name) we have seen so far this decade has mainly led to the warm feeling found at the center of the herd on a cold winter day, as the efforts of the main central banks has led to asset price inflation. But some investors, have at various intervals over the last decade, sobered up briefly from the spiked FOMO Cool-Aid to face the nagging question; Has this intoxicating ‘warmth’ not got some of the characteristics of peeing your pants to stay warm?

Maybe our debasement experience will be more akin to a dog left in a hot car on a midsummer day as opposed to that of the lobster dropped directly into a boiling inferno. Dehydration through heat exhaustion is a slower but equally lethal force, it leads initially to loss of strength and stamina before delirium gradually takes over as the system shuts down. Looking around global markets today there are signs of delirium.

With debt and deficit levels at historic highs and the beast of deflation at the gate with no real way out, it may be more instructive to take a look at some of history’s examples that does not involve wheelbarrows full of Reichsmark. Ideally, we can glean some lessons on what to expect on the path ahead and find some ways for investors to protect themselves and perhaps even harness these powerful forces underway for gain.”

We live in interesting times. With Marko’s insights and thought frameworks you will be better positioned for navigating the path ahead so get his amazing book; ‘Geopolitical Alpha: An investment framework for predicting the future’ and read it and re-read it. It will be worth your time.

Next month, in this two-piece series, I will share my key takeaways from Azeem Azhar’s great book; ‘Exponential: How accelerating technology is leaving us behind and what to do about it.’