BIS Bashes Crypto

Macro Trends:

In this week’s edition Sune Hojgaard Sorensen, our Director of Macro Research, shares 3 illustrations on the US stock markets that warrant some attention.

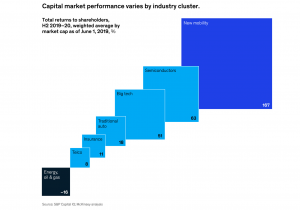

Get Active – While the “crawler” all too often focuses on the daily moves at the index level – Are we in the Green today? – Investors should pay attention to the trends below the surface. Getting active and reviewing the sectors that are supported by broader trends and are set to outperform leads to outperformance. Asset allocation at the sector level matters. The markets’ favored sectors, such as semiconductors and big tech, have done well over the past year and a half. But mobility has outperformed them all. Understanding the Macro can enhance your ability to get the Micro right and harness global trends for gains.

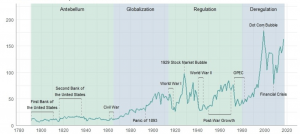

Take the long view – US stock market capitalization relative to the US GDP is moving towards record levels since record began back in the 1790s. The last record was back in 1999. The current round of COVID-19-related QE has widened the deviation. The current mismatch between equity market cap and GDP is the highest and longest lasting in the last 50 years. Every time the market cap has deviated so sharply from GDP, it has snapped back with equal force. Caveat emptor…Best have an All-Weather strategy in place.

US Stock Market Capitalization Relative to US GDP

Source: https://globalfinancialdata.com/the-growth-of-the-american-stock-market

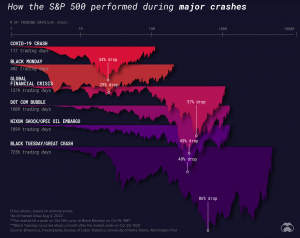

Be prepared – Like spectacular market peaks, market crashes have been a persistent feature of the S&P 500 throughout time. “Drawing data from Macrotrends, this infographic compares six historic market crashes—examining the length of their recoveries and the contextual factors influencing their durations. The forces underpinning each rise and fall are often less clear. Take the COVID-19 crash, for example. Despite lagging economic growth and historic unemployment levels, the S&P 500 bounced back 47% in just five months, in a stunning reversal.”

Source: https://www.visualcapitalist.com/sp-500-market-crashes/

Micro Moves:

This week our Crypto Market Analyst, Toa Lohe & Sune, looks at how the global regulatory framework for crypto is evolving from the Central Bankers perspective.

The BIS continues to explore and outline perceived risks emanating from the Crypto sphere and are increasingly using muscular language about how to control and regulate the space.

In our past Strategic Perspective https://www.thestrategicfunds.com.pr/the-strategic-perspective-week-of-mar-26-2021/ we explored the moves at the CBDC & mCBDC level and the potential implications for Crypto and Toa looked at the potential implications of President Biden’s nomination for the SEC – Gary Gensler – in our last edition https://www.thestrategicfunds.com.pr/the-strategic-perspective-week-of-apr-1-2021/

This week we take a look at a recent report from the BIS’ Financial Stability Institute with the catchy title; ‘Supervising cryptoassets for anti-money laundering’. Read it here in full: https://www.bis.org/fsi/publ/insights31.pdf

The report essentially outlines areas of risk and suggests very centralized regulation and oversight of what is an emerging global decentralized counter movement. It shows how different nations has approached this evolving space so far and one can’t help but see it as yet another sign of the inherent friction between two tectonic plates – the analog world of nation states and our increasingly borderless digital reality. Expect tension to continue to build up as the landscape shifts and adjusts.

They start with a hat-tip to the innovation and its potential benefits and then shifts right into brass knuckle tactics by dropping the “T-Word” – ‘Terrorist financing’;

“While certain cryptoassets have the potential to make payments and transfers more efficient, some of their features may heighten money laundering/Terrorist financing (ML/TF) risks. In particular, the speed of transactions, global reach and potential for increased anonymity and obfuscation of transaction flows and counterparties make cryptoassets particularly suitable for criminal uses. In addition, some transactions may take place without the involvement of financial intermediaries, in which case no regulated financial institution can necessarily apply AML/CFT preventive measures, such as customer due diligence, record-keeping and suspicious transaction reporting. Moreover, many cryptoassets or service providers specifically incorporate technology designed to prevent transparency, such as tumbling or mixing services or anonymity-enhanced coins (AECs).”

“The scale of illicit use of cryptoassets is significant, highlighting the importance of AML/CFT regulation and supervision, as well as law enforcement, in this area. One private sector firm estimates that in 2019 about 1.1% of all cryptocurrency transactions (worth around USD 11 billion) were illicit, an increase from the previous two years. Another firm found in looking at Bitcoin alone that in 2020 criminally associated bitcoin addresses sent USD 3.5 billion. The same source also estimates that a third of the bitcoin sent across borders goes to exchanges with obviously weak customer due diligence controls. The above figures underscore the scale and urgency of the ML/TF threat from cryptoassets and the importance of effective regulation and supervision.”

“International cooperation to oversee this sector effectively is key. The inherently cross-border nature of cryptoassets, as well as the uneven global implementation of international standards in this area, make international cooperation a critical component for effective supervision. This is especially true in view of how new the sector is. Supervisors appear to have the necessary legal authorities and channels for international cooperation in place, but actual use of them is another area requiring improvement.”

“There is a clear need for supervisory innovation to match the innovative nature of the cryptoasset sector. National authorities believe that suptech technologies such as machine learning and artificial intelligence can greatly help in the effective supervision of cryptoasset activities. The existence of a public blockchain for many cryptoassets creates an additional data set that authorities may be able to use. Dutch authorities, for example, are working on new, data-driven approaches to supervision to take advantage of the digitalisation and data-rich nature of the cryptoasset landscape.”

“In addition, supervision of CSPs is in its early stages in most jurisdictions and further efforts are needed to bring it up to speed. The implementation of effective supervisory practices is in a nascent phase in most jurisdictions, and more work is needed to ensure CSPs’ compliance with AML/CFT obligations. Similarly, the number of enforcement actions taken in this space remains limited at this stage. While this is natural considering the recency of regulation in most surveyed jurisdictions, further attention in this area is needed as on-site inspections and enforcement actions are fundamental elements of deterrence and education.

As cryptoasset markets mature, cooperation and coordination at national and international level will be crucial. Innovations in cryptoassets and business models will continue to emerge and evolve, posing new challenges at a national and international level. This may require cross-sectoral, cross-authority and cross-border cooperation to monitor new and emerging risks, ensure adequate coordination and avoid regulatory arbitrage in the cryptoasset space. Information-sharing on innovative technologies may also go a long way towards enhancing the effectiveness of AML/CFT supervision.

Finally, there is a critical need for swift and global implementation of international standards. The inherently global nature of cryptoassets lends itself to regulatory and supervisory arbitrage. Jurisdictions cannot fully mitigate their risks as long as they are exposed to weaknesses and inconsistencies across borders. Consistent implementation of the international standards, especially those defined by the FATF, is essential.”

Privacy and decentralization meets the reality of a status quo that is built on the premise of centralized oversight and regulations – investors and operators in the space should take note. Eventually this will lead to a more transparent and predictable framework for operations, but it will grind down some of the freedoms, the flexibility and return profiles as the two worlds collide and merge into the next iteration of a global financial system during this decade.

Recommended content from our explorations this week:

Liliy Francus talks options, passive investing and speculation with Jim on the ‘Infinite Loops’ podcast: https://www.infiniteloopspodcast.com/lily-francus-options-passive-speculation/

Visualize Coinbase’s brisk user growth ahead of IPO:

https://www.visualcapitalist.com/coinbase-experiences-brisk-user-growth-ahead-of-ipo/

How fast did Bitcoin hit the $1trln market cap compared to others? https://www.visualcapitalist.com/bitcoin-is-the-fastest-asset-to-reach-a-1-trillion-market-cap/